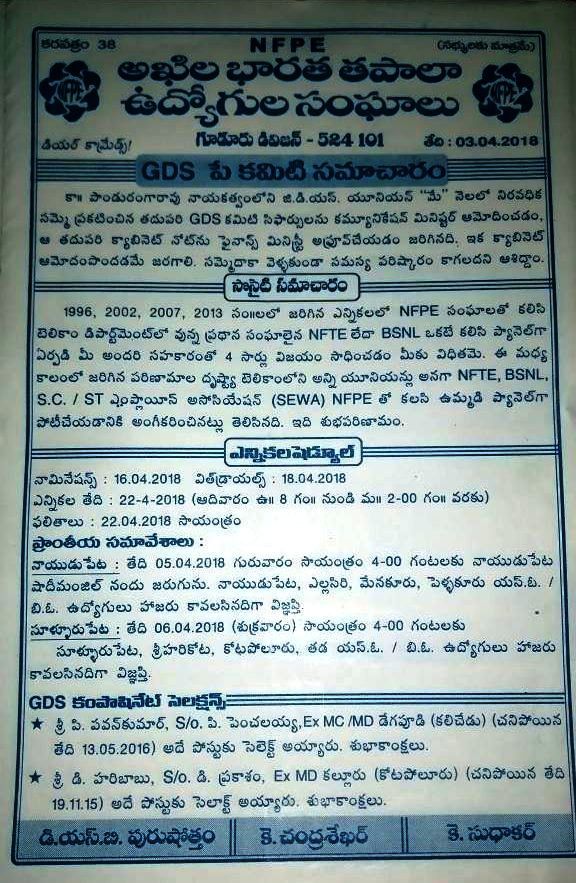

Total number of vacancies notified in AP Circle : 2286

Total number of vacancies in Gudur

Division: 46

Category

|

OC

|

OBC

|

SC

|

ST

|

PH

|

TOTAL

|

BPM

|

8

|

2

|

2

|

2

|

1

|

15

|

GDSMC

|

9

|

4

|

1

|

2

|

1

|

17

|

GDSMD

|

9

|

3

|

1

|

1

|

0

|

14

|

Last Date to Apply Online: 24-05-2018

*****

Indian Postal Department (Andhra Pradesh) Recruitment for 2286 Gramin Dak Sevak Posts 2018

Indian Postal Department (Andhra Pradesh) has published Advertisement for below mentioned Posts 2018. Other details like age limit, educational qualification, selection process, application fee and how to apply are given below.

Posts: Gramin Dak Sevaks (GDS)

Total No. of Posts: 2286 in various divisions

Educational Qualification: The candidate should pass 10th standard / SSC / Matriculation from approved state boards by the respective State Govt. / Central Govt. The state wise list of approved boards. No weightage will be given for possessing any qualification(s) higher than the mandatory educational qualification. The Candidate passed 10th class examination in first attempt will be treated as meritorious against those passed compartmentally.

Computer Knowledge: The candidate should have computer knowledge and will be required to furnish basic computer training certificate for at least 60 days from a recognized Computer Training Institute. Certificates from Central Government/ State Government/ University/ Boards etc., will also be acceptable for this purpose. This requirement of basic computer knowledge certificate shall be relax-able in cases where a candidate has studied computer as a subject in Class X or Class XII or higher educational qualification provided the candidate submits a certificate of Class X or Class XII or higher educational qualification in which he/she has studied computer as a subject.

Job Residence: The candidate selected for the post of GDS BPM must mandatorily take up his/her residence in the Branch Post Office village within one month after selection but before engagement as Gramin Dak Sevak Branch Postmaster. The candidate shall submit a declaration to this effect in the application. The candidate selected for the post of other than GDS BPM should reside in post village/ delivery jurisdiction.

Age Limit: Minimum 18 Years and Maximum 40 Years as on 25th April 2018. The Upper Age Relaxation - 03 Years for OBC, 05 Years for SC / ST and 10 Years for PH Category Candidates

Application Fees: Applicant of category OC / OBC Male should pay a fee of Rs. 100/- at any Head Post Office. Candidate who requires to make the payment has to visit any Head Post Office to make the payment. For making the payment candidate should inform Registration Number at the PO Counter. However, fee payment is exempted for all Female and SC/ST candidates.

Selection Process: The selection based on 10th Standard Marks. No weightage will be given for higher educational qualification. Only marks obtained in 10th standard / Matric of state Govt approved Boards aggregated to percentage to the accuracy of 4 decimals will be the criteria for finalizing the selection.

How to Apply: Eligible Candidates are required to register Online application through India Post / AP Post GDS Online Portal with the basic details to obtain the Registration Number. Candidates already once registered in AP Post GDS posts need not register again.

Last Date to Apply Online: 24-05-2018

Advertisement: CLICK HERE

Apply Online: CLICK HERE

Help Desk: For any queries related to this recruitment contact Andhra Pradesh Circle - 0866-2429822 OR Email to apcorecruitment@gmail.com and queries related to website may be given to dopgdsenquiry@gmail.com

//copy//